If You Want Me to Pay My Taxes

If You Want Me to Pay My Taxes

Americans tend to imagine that aversion to taxation is deeply rooted in our national political culture. Not so fast, Vanessa S. Williamson argues in her new book, The Price of Democracy.

The Price of Democracy: The Revolutionary Power of Taxation in American History

by Vanessa S. Williamson

Basic Books, 2025, 352 pp.

Americans tend to imagine that aversion to taxation is deeply rooted in our national political culture. Didn’t the founders rally behind the slogan “no taxation without representation”? Don’t all Americans—even those favoring regulation and a strong social safety net—always prefer lower taxes? Isn’t this why we can’t afford to have nice things?

Not so fast, Vanessa Williamson argues in her new book, The Price of Democracy. Williamson finds that taxation recurs as a major subject of political contestation throughout U.S. history—but not because Americans won’t pay. At issue in these conflicts, she argues, are fundamental questions about what the nation is, and what democracy, freedom, and equality mean. Public revenue systems are “contested most fiercely when the scope of the public itself is disputed.”

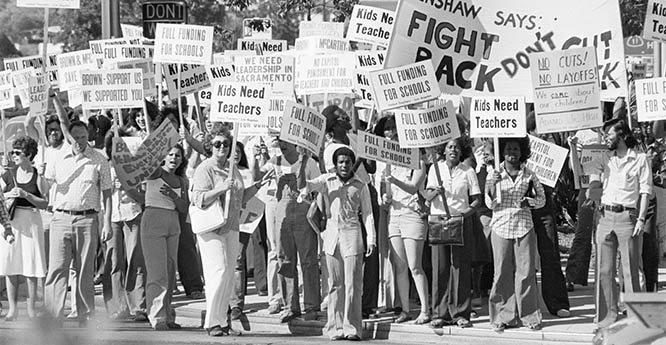

Whenever poorer groups of Americans sought to establish a more democratic government that could and would tax in the public interest, antidemocratic elites responded by either curtailing the state’s taxing powers, by making “government less accountable to the public, or both,” Williamson argues. White elites have also sought to build a more popular base for these efforts by stoking racial animus and claiming taxation itself as an antidemocratic imposition.

The Price of Democracy does not provide a program for mobilizing in favor of more democratic taxation in our own day. Still, strategists can take inspiration from the long history of support for taxes used to achieve more egalitarian distributions of income and wealth and to fund social benefits. Williamson’s precedents give reason to hope that popular plans to tax the rich can find traction across the country, even if anti-tax sentiment on the right remains a strong political current in the United States. The Price of Democracy suggests that advocating tax policies designed to benefit the 99 percent should be part of our strategy for taking on the Trump regime. It invites us to consider new coalitions that might rally behind a program of democratic taxation, and what that program might look like.

In the years before the American Revolution, North American British colonists grew agitated over new and increased taxes imposed by the Crown, used to fund the enlargement of the British military, which constrained colonists in their push into the interior of the continent. It wasn’t taxes per se that rankled colonists, Williamson contends, but the fact that their local legislatures had been bypassed. In articulating their objections to the British government’s fiscal policies, North American colonists held that they represented a seizure of sovereign power, threatening their economic and political independence. ...

Subscribe now to read the full article

Online OnlyFor just $19.95 a year, get access to new issues and decades' worth of archives on our site.

|

Print + OnlineFor $35 a year, get new issues delivered to your door and access to our full online archives.

|