Our Political System Is Hostile to Real Reform

Our Political System Is Hostile to Real Reform

The stimulus bill doesn’t come anywhere near to meeting the challenge that we face.

On March 10 I started texting with some of my colleagues at the Roosevelt Institute, the economic policy think tank where I work, about the need to think through what a response to a coronavirus-induced recession would look like. In my head, the aggressive ask was $500 billion. Nine days later in the Nation, I wrote a column laying out some ideas. (It was written for print; we had to revise it multiple times in the days before it went online to keep up with the changing landscape.) There I argued that we needed to think about a $1.5 trillion proposal, higher than what people were considering at the time. Now, two weeks and two days after people first started discussing legislation, Congress is about to pass a $2.2 trillion response called the CARES (Coronavirus Aid, Relief, and Economic Security) Act.

Yet I feel exhausted, disappointed, and angry. Part of this is just a response to the situation we face, which is worse than we all had imagined—a shock to our social, economic, and political lives. No doubt, I, like many under social distancing and isolation, am feeling the slow fatigue and grief of fighting this disease. But that doesn’t explain it all. Something was missed in this moment. This bill will help a lot of people and do a lot of necessary things, and perhaps Congress will pass another bill to supplement it in a month, as many hope. But it doesn’t feel like enough. It doesn’t come anywhere near to meeting the challenge that we face.

What has been frustrating is to see so many ideas—ideas that once seemed impossible to imagine in our political system—suddenly emerge into the realm of possibility, only to collapse once they hit the hard reality of a system hostile to radical change and serious economic reforms. The ideas were there, and were heard. Universal unemployment insurance, a coordinated national labor policy, and a basic income were all discussed at a level that was unthinkable a month ago. All are necessary to freeze the national economy, with the government paying expenses in the meantime, so it could thaw out after the pandemic is over. But trying to get them over the finish line of legislation forced me to see how difficult it is to carry out serious programs in a system that is innately hostile to reform and has become less and less responsive to everyday people in recent decades. This isn’t to excuse the political choices that were made this week. Nor is it to downplay the real benefits that this bill will bring. But we need to recognize that this crisis, or any crisis, isn’t enough to win the policies we want and need.

Consider the idea of a massive expansion of unemployment insurance, as economist Arindrajit Dube had proposed. It is a simple, yet radical, response to the crisis. Everyone goes furloughed for a few months, the government picks up the tab, and then everyone goes back to work. People continue to get paid, at an income replacement level of 100 percent. Employers lose their biggest budget line item, meaning they are much more likely to stay in business while they close as needed.

I believe Senator Chuck Schumer when he said he wanted to do “unemployment insurance on steroids.” But this idea ran straight into the ugly reality of our actually existing unemployment system, which is dominated by state governments that often have little interest in making the system work well. States determine eligibility terms (how many people who become unemployed use the program), as well as replacement rates (how much of their prior income they receive). According to the National Employment Law Project, states have been driving down these rates since the Great Recession, starving them of resources. They are being creative in how to limit the programs, instead of how to modernize them for our current digital age.

These trends reflect dysfunctional elements both old and new. The creators of the Social Security Act, which included both old-age pensions and unemployment insurance, understood that this system was a mess. But in 1935 they believed a hostile Supreme Court would likely kill the law, but might spare components that operated at the state level. The system was a hedge against a conservative court system. More recently, the status of workers has become more legally precarious. The employment relationship, along with unemployment insurance, has been whittled away. In this “fissured workplace,” as public policy professor David Weil describes it, millions of workers that were once directly employed by their actual bosses have been legally reclassified as contractors and other arm’s-length contractual relations. Workers are likely to receive less of the gains of what they produce. And if they aren’t employees who can be laid off, they don’t have the infrastructure of unemployment insurance to protect them.

What can you do when you want to provide unemployment insurance to people not within the system, and in a system hostile to expansion at that? The workaround Congress found is quite simple and smart. First, to boost replacement, add $600-per-week onto what people would normally get if they qualify for unemployment insurance. This allows a massive increase in the replacement rate across the board, without having to fight states on their specific mechanisms for determining what that rate is. Second it is extended for those who don’t normally qualify like contractors and the self-employed, using a simple formula that then gets the $600-per-week added to it. This system, duct-taped as it may be, does get social insurance to those normally excluded, and also does more wage replacement for lower-income workers. (That it might leave workers better off not working than working almost caused Republican senators to kill the deal.) It’s $260 billion dollars’ worth of social insurance straight to workers.

It’s a tradeoff that accomplishes much now at the expense of creating a long-term solution. This is the theme of the entire congressional relief effort—victories were won for things that can pass and work immediately, but not for policies that would be able to continue in the aftermath of the crisis, or at least provide a basis of support for that continuation.

Take the new paid sick leave policy for those dealing with coronavirus that passed last week. There have been decades of efforts to pass this sort of legislation, and here a temporary version of it emerged and passed in the span of two weeks! But instead of a general social insurance fund, as advocates called for, it’s a mandated employer benefit that the government reimburses after the fact. Will workers enjoy this benefit? Will they see it as an important part of their economic security? Will it open a door to a larger conversation about rethinking care and health, or simply be another disappointing stopgap in this crisis?

The resistance of the U.S. system to reform can be seen clearly when we consider an even bolder proposal: putting the entire economy, and not just the workforce, into a freezer for the length of the pandemic. The government would take over paying workers in the private sector and certain businesses expenses until the crisis passes. The economists Gabriel Zucman and Emmanuel Saez proposed such a plan. Though they are on the left, limited versions of such proposals were also floated by conservative economists such as Glenn Hubbard.

The dawning realization of how severe the coronavirus recession will be, with many small- and medium-sized businesses facing complete destruction, has made clear the urgency of such a proposal. It’s also what other countries have done. Denmark rapidly negotiated a plan to pay workers at businesses affected by the crisis 75 percent of their salaries. In the UK, employers can apply for government grants to cover 80 percent of wages.

Trying to do this in the United States, a large country with multiple levels of execution and administration, will prove much harder. How do you even begin such a process? Union density is over two-thirds in Denmark, and the country has a tripartite system of sectoral bargaining, in which the state, labor, and capital were quickly able to execute a plan. In the United States, there’s a massive institutional void where such a debate could take place. There’s no way for labor as a whole to articulate terms with employers, with the government as negotiator. That would require a labor policy approach that our country abandoned many decades ago.

Instead, a more limited effort along these lines will be carried out through the Small Business Administration, a tiny government agency that largely works through the existing banking system to get better terms on private loans—part of a long history of private delegation of public action in the United States. We are essentially left to hope we can freeze small businesses through loans and grants executed through the banking system, who get to skim off the top. The $360 billion will run out, probably quickly, which means there will be a real availability problem in whether businesses can access these funds. Because of our fissured workplace, it’s likely many franchise owners of “small businesses” licensed by large corporations (like chain restaurants) will qualify, while having access to corporate resources to navigate the system faster than others. It will be a patchy and messy solution to something that should have been more comprehensive and universal.

Even the most straightforward economic security mechanism, sending people checks, ran into the mess of our system. A universal basic income, or social dividend, has been an animating idea on the left and elsewhere for a long time. The policy book Recession Ready, published last year, specifically outlined how a program to send out checks during a recession could work as an automatic stabilizer, providing economic support when Congress can’t. Part of the selling point is how easy it should be to execute: it doesn’t get lost in a maze of eligibility requirements. But we don’t have a complete list of people, or a directory of addresses. To send out the $1,200 checks per person (and $500 per dependent) that are part of this bill, Congress and the IRS will have to use information from old tax returns, but not everyone files taxes, especially those who would need the money the most in a crisis. There’s actually language in the bill to create a “public awareness campaign” to let people know that they would be eligible even if the government doesn’t already have their record. Though in those cases, it will take months to actually get the check into place. And because so many are unbanked or underbanked, predatory institutions will be able to get a cut. This is not the effortless flow of cash most basic income proponents have in mind when they imagine the program.

Worse still, the proposal that made it into the CARES act is set up to terminate after just one payment. To renew it, we’ll have to negotiate this all over again in a few months, with a Senate that already gave a backstop to corporate America, or next year, perhaps with a Democratic president and a Republican Senate that will demand cuts to programs in exchange. That these payments don’t automatically trigger again throughout the recession is a failure. People are left with a single check they may struggle to receive and cash. Meanwhile, the federal government has found at least $50 billion for the Treasury to bail out airlines and national security firms—money that might come with basically no strings attached.

It’s telling that one of the few institutions operating at the scale of the crisis is the Federal Reserve. The country’s central bank, the Fed has the ability to intervene directly in financial markets. The CARES Act will give the Federal Reserve $454 billion to create a series of lending programs. It will be successful in freezing the bond market, allowing private capital to go into hiding while taking over and keeping businesses alive long enough to thaw out when the pandemic is over. Freezing the entire economy until the pandemic is over is what should be happening everywhere, but only the Fed is resourced, competent, and capable of doing this job. The question now becomes how much it will do to freeze and backstop municipal governments and small businesses. It will have to do what Congress can’t.

Many of us have the intuition that times of major crisis provide an opportunity for radical, brand new changes. I’m not sure if that’s true, historically. The Civil War brought about the existing Whig agenda of homesteads, colleges, and improvements that had stalled under a Democratic Senate and presidency in the late 1850s. The New Deal’s first wave of public programs mirrored those from the First World War. During a crisis, people go to what is already on the shelf. But even if the stuff on the shelf is bold and new, as it is in our current moment with a new progressive coalition becoming more assertive, there need to be mechanisms to click things into place. It requires work on both ends of the equation: the big ideas, but also the mundane reforms, like a database of addresses where we can send checks, that we need to execute them. Though many will be better off from this bill, it represents a real failure to secure long-lasting reforms. The goal now is to take the fragments of the better world suggested here, and try to build on them next time.

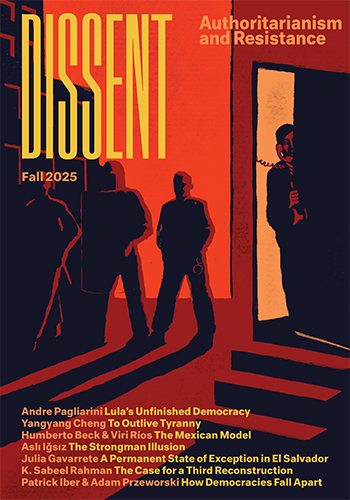

Mike Konczal is a fellow at the Roosevelt Institute and a member of Dissent’s editorial board.