Social Policy and Poverty: Don’t Fear Europe!

Social Policy and Poverty: Don’t Fear Europe!

My own education in American social policy began intensively in 1980. That year, three events cemented my interest in American poverty and the U.S. public response to it.

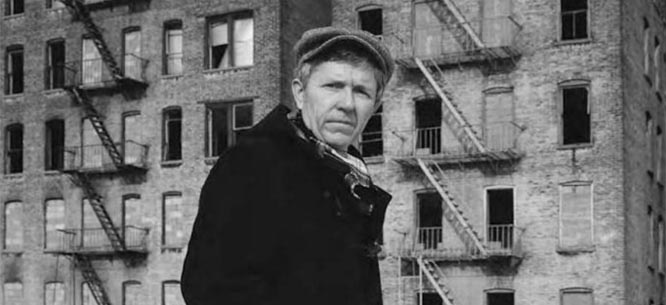

The following is adapted from a talk delivered at the fiftieth anniversary celebration of Michael Harrington’s The Other America, held on September 10, 2012 at the CUNY Graduate Center, and from a Graduate Center Commencement Address, which was delivered on May 24, 2012.

This event caused me to think back to earlier years. My own education in American social policy began intensively in 1980. That year, three events cemented my interest in American poverty and the U.S. public response to it.

First—if you’ll indulge me in a moment of autobiography—I began a job as a social policy researcher at the Urban Institute, a policy research center in Washington. Second, eight weeks after I arrived in D.C., Ronald Reagan was elected president. Shocking as that moment was—for those of us in D.C., and everyone around the world—we didn’t realize then that he would launch a redefinition of America’s poor and a recasting of anti-poverty policy that would affect the United States for decades. And third, that fall I read The Other America. (That was the same year that Michael Harrington added his second epilogue.)

Like so many, I was electrified by The Other America. I reread it again this past weekend, probably for the fourth time, and I still find it electrifying. That said, I think it’s important to acknowledge that elements of the book are clearly dated.

First of all, the face of poverty has changed markedly, in ways that require us to think about needed social policy reforms somewhat differently than Harrington did in 1962. Probably the most dramatic change since 1962 relates to age. When The Other America was written, relative to the whole population, the elderly were much more likely to be poor and children much less so. Today that pattern has reversed. In 2010, nearly 15 percent of Americans were poor (based on the U.S. definition); that number was 9 percent for the elderly and a stunning 22 percent for children.

That sharp rise in children’s poverty, of course, goes hand in hand with the feminization of poverty, especially among parents raising children without partners. In 1960, less than one-third of poor families were headed by a single parent; today more than two-thirds of poor families are headed by a single parent—and in four out of five of those families, that single parent is a woman.

In addition, the face of poverty has grown more urban, and less rural. Most dramatically, the number and percentage of people living in extremely poor rural pockets (rural counties over 40 percent poor) has declined dramatically.

It’s also the case that our collective understanding of poverty’s roots has matured and clarified. In The Other America, Harrington wrote extensively about “the culture of poverty,” a combination of despair, low aspirations, broken spirits, and the like. And yes, he pointed to a set of problematic behaviors: weak attachment to paid work, drug use, crime.

Of course, that phrase (“the culture of poverty”) became toxic in subsequent years—and, not surprisingly, Harrington did not use it in his later work. When I say that it became toxic, I mean that in recent decades conservatives fueled their calls for social policy cuts by invoking cultural explanations for poverty. Meaning, they argued that poor people are poor because of attitudes and behaviors that characterize them and their communities. It’s been reported that Harrington later regretted his use of the term, but even a cursory read of the book clarifies that he never suggested that poor people “bring to the table” traits that cause them to be poor. As he wrote, “The personal ills of the poor are a social consequence, not a bit of biography about them. They will continue as long as the environment of poverty persists.”

Finally, Harrington wrote The Other America before the second wave of the feminist movement awakened Americans to the downside of the sexual divisions of labor that characterized the United States (or at least the middle class and affluent United States) during the 1950s. In 1962, Harrington wrote mournfully that, for many families, the only route out of poverty was for wives to work for pay. That, he worried, would come at the “cost of hurting…hundreds of thousands of children.” He wrote: “If a person has more money but achieves this through mortgaging the future, who is to say that he or she is no longer poor?”

The following year, in 1963, Betty Friedan’s The Feminine Mystique was published—and much has happened since then. I think it goes without saying that, were Harrington with us today, he would write very differently about the causes and consequences of women’s employment.

All that said, I began by saying that the book is still electrifying—and I mean that. Why? For two interlocking reasons.

First, he argued persuasively that American poverty is by no means inevitable. It is a social and political construction; therefore, a well-designed and adequately financed package of public policies (especially national-level policies) could dramatically reduce the prevalence of poverty in the United States. As he wrote, “There is information enough for action. All that is lacking is political will.” That is every bit as true today as it was in 1962. By and large, we know which public policies would sharply reduce poverty in the United States. What we lack, indeed, is political will.

Second, because so much poverty is preventable, Harrington urged his readers to refuse to accept American poverty: “After one reads the facts, either there are anger and shame, or there are not. And, as usual, the fate of the poor hangs upon the decision of the better off. If this anger and shame are not forthcoming, someone can write a book about the other America a generation from now, and it will be the same, or worse.”

So, where are we today?

After a precipitous decline in U.S. poverty rates throughout the 1960s—the War on Poverty was effective—poverty reduction stalled in the middle 1970s. Since then, the poverty rate has bounced around, usually fluctuating with recessions and recoveries, but we’ve made virtually no long-term progress. On the eve of the current recession, the U.S. poverty rate was exactly what it was in the middle 1970s. Now it is higher than it was at the close of the War on Poverty at the end of the 1960s.

And now we have a second story to consider, about income inequality. In the last three decades, while poverty rates have stagnated, income inequality in the United States has grown steadily. That is partly because the poor have gotten poorer and partly because of marked income growth at the top—especially at the very top. Rising inequality has multiple causes, and among the most consequential are the social assistance cuts and the tax reforms that we associate with the Reagan Revolution.

We all know that something important happened last year with the launch of Occupy Wall Street. While it will take a while to discern the effects of Occupy, one impact is indisputable. It suddenly and effectively cast a bright light on income inequality in the United States.

I’ve been hugely grateful for this burst of attention. But I’ve also been keenly disappointed by one conversation that has failed to emerge, about the many policy lessons that we could, and should, draw from other affluent countries.

A recent study of twenty-five of the richest countries in the world revealed that—among them—the United States has the highest poverty rate and the highest level of income inequality. This gives further weight to Harrington’s crucial argument that a great deal of economic hardship in the United States is the direct result of American social policies.

An enormous number of U.S. workers earn very low wages. Fully 24 percent of U.S. workers earn less than two-thirds of median earnings. That means that more than 30 million workers earn less than about $11 an hour—or $22,000 a year if they work full-time throughout the year. Annual earnings at that level fall short of the poverty threshold for a family of four, and barely exceed the threshold for smaller families.

It is by no means inevitable that a quarter of American workers earn low wages. Many other high-income countries—with diverse social policies and varied labor markets—effectively limit the incidence of low-wage work. Using the common “two-thirds of the median” standard, 18 percent of workers in Germany earn low pay, 16 percent in Austria and Japan, 15 percent in Australia and New Zealand, and 7-8 percent in the Northern European countries. The prevalence of low pay in the United States is much higher than the average rate across thirty rich western countries.

Now, let’s focus on two comparative policy questions.

The first question is: how do other rich countries limit the prevalence of low-wage work? The answer is: through three instruments of social policy. First, they secure adequate wage floors by setting high minimum wages. Second, they shore up workers’ bargaining power by strengthening decision-making bodies that include workers, by providing adequate unemployment insurance, and by limiting forms of public assistance that force workers into low-paid jobs. And third, they operate what are known as “active labor market policies,” including public training, re-skilling, and employment services, which together reduce the incidence of low pay and raise earnings mobility. In comparative perspective, the U.S. minimum wage is rock bottom, our institutions grant workers minimal bargaining power, and our investments in active labor market policy are negligible.

The second question is: how do other rich countries mitigate the effects of low earnings? A large research literature—to which I’ve contributed—has assessed the extent to which public tax and income transfer policies provide economic security to those who receive too little from the market. The clear consensus is that U.S. income policies are much less redistributive than those that operate elsewhere. The limited reach of the U.S. income-tax-and-transfer system tightens the link between low earnings and low household income. That is why American poverty rates and income inequality reach levels rarely seen in the world’s affluent countries.

What about other social protections? Most rich countries also provide an array of rights and benefits that offset the hardship of both low earnings and limited income. Of the twenty-five richest countries in the western world:

• Only the United States fails to provide national health insurance. The Affordable Care Act is a step forward, but a partial one. U.S. health policies result—and will continue to result—in health expenditure burdens on U.S. workers and their families well above those in other countries, even after accounting for higher taxes elsewhere.

• Only the United States has no national policy granting workers a minimum number of paid days off each year. As a result, our annual employment hours are among the longest in the world.

• Only the United States has no national policy granting employees a right to paid sick days. That means that our workers routinely go to work when they are sick, and when their children are sick.

• Only the United States has no national policy of paid maternity leave in the wake of birth or adoption. That forces millions of U.S. women to choose between returning to paid work before it’s safe and feasible, or taking a leave and absorbing an income loss at exactly the moment that their families have expanded.

In the United States, the absence of national laws that secure workers’ rights—to health insurance, annual leave, sick leave, maternity pay, and the like—bring tremendous hardship to many low-earning workers, piling employment instability and high out-of-pocket expenditures on top of low income. And leaving these types of benefits to the marketplace, as we do in the United States, adds a further layer of inequality. High-earning workers are often granted these rights and benefits through voluntary arrangements provided by their employers, while low-paid workers are rarely granted any of these supports. When we look at earnings and working conditions together, the picture is extremely regressive.

Finally, among these twenty-five richest countries, the United States invests the smallest share of public dollars in early childhood education and care, and our university students pay the highest tuition. That imposes educational disparities on our youngest children, and constrains equality of access to higher education.

I could go on. In the end, my point is a simple one: the miserliness of American social policy leads directly to a multitude of painful consequences. And those include none more consequential (and more unacceptable) than our high poverty rates and our excessive levels of income inequality.

I could not feel more strongly about the necessity and value of looking abroad for policy inspiration. There are countless concrete lessons to be learned. And while I am not speaking exclusively of Europe, I do include several European countries among the cases from which, I would argue, we can learn.

I have been around long enough to know that that can be a perilous political path in the United States. And that is true now more than ever, given the economic crises that are unfolding in some European countries. While we do not know where they will lead, we know that the kinds of social policies that I have pointed to as models are not the cause.

The countries in Europe (mostly in Western and Northern Europe) that have most successfully prevented low wages, high poverty, and high inequality—with virtually no exceptions—are all macro-economically healthy, or at least as healthy as an economy can be in the middle of a global recession. The Nordic countries, the Benelux countries, Germany, Switzerland—they all have lower unemployment rates and lower debt-to-GDP ratios than does the United States.

So don’t be dissuaded by politically motivated Europe-bashing. And remember that the last thirty years don’t represent the entire history of American social policy development. The United States ushered in important social policy expansions during the Progressive Era, the New Deal, and the Great Society. The staunch rightward turn—the war on social policy—is relatively young. We should resist the misguided refrain that American social policy today is what it is because of factors engraved in stone centuries ago. We have seen progressive policy reforms in the past, and we ought to be able to produce progressive policy reforms in the future. That, as Michael Harrington told us, demands political will—and a measure of collective anger and shame.

Janet Gornick is a professor of political science and sociology at the Graduate Center of the City University of New York (CUNY). She is also the director of LIS (formerly, the Luxembourg Income Study), a cross-national data archive and research center, located in Luxembourg, with a satellite office at CUNY.

Photo of Michael Harrington by Bob Adelman